BNG Pricing Report February 2026: Two Years On

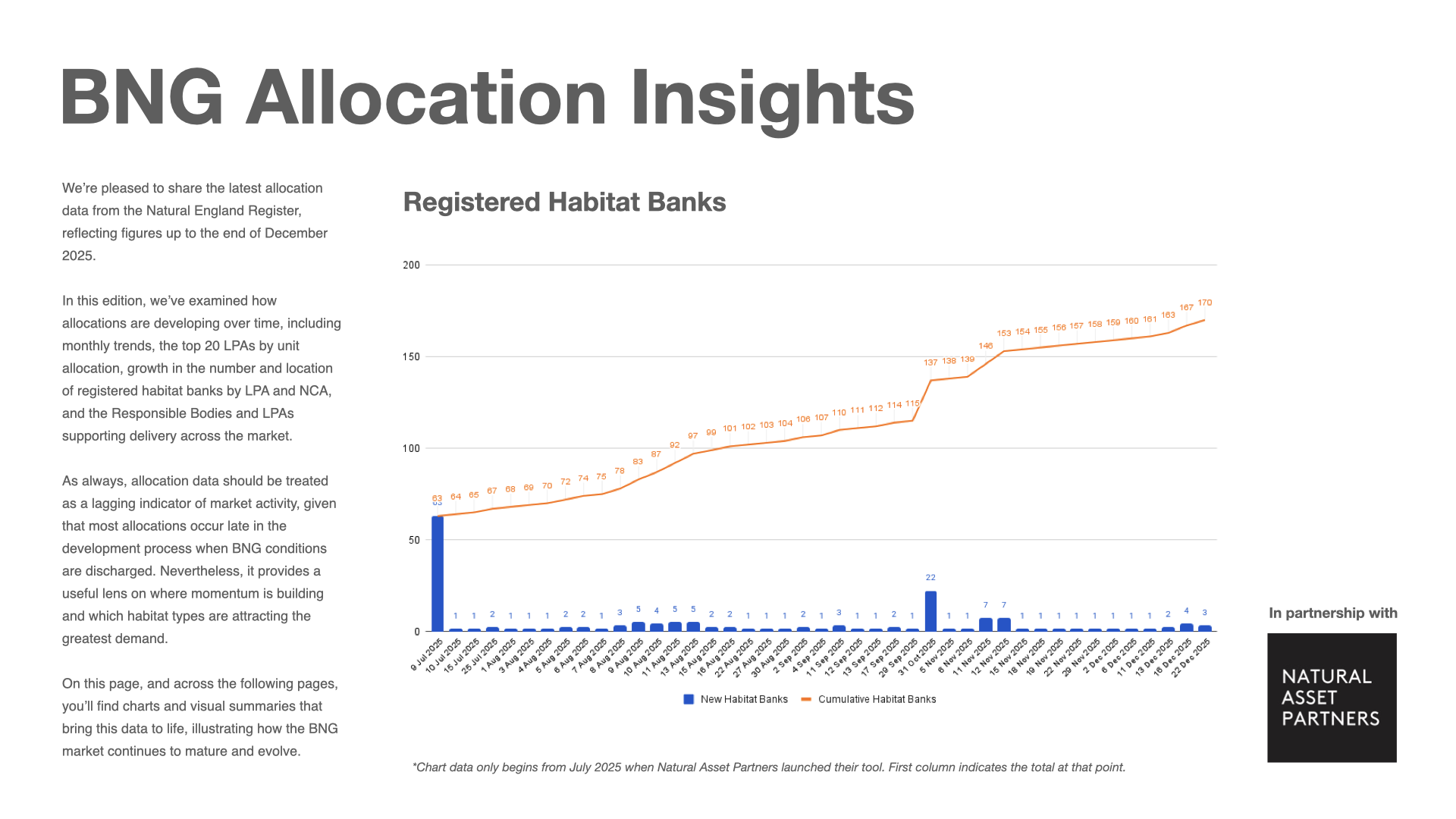

Our February 2026 BNG Pricing Report - timed to launch with the two year anniversary of Biodiversity Net Gain - now includes data from 165 habitat banks.

This edition is both updated and expanded as we introduce:

2025 recap from industry leaders

New habitat types

Opinion section

Natural Asset Partners return with a fresh analysis of the Natural England Register - from their BNG Data Insights platform.

We are grateful for all the Habitat Banks who trust us with their commercial data - without you we could not provide this ongoing market transparency and intelligence.

Get the full February 2026 BNG Pricing & Insights Report: sign up here.

Key insights: a dynamic market

Selective price softening is emerging

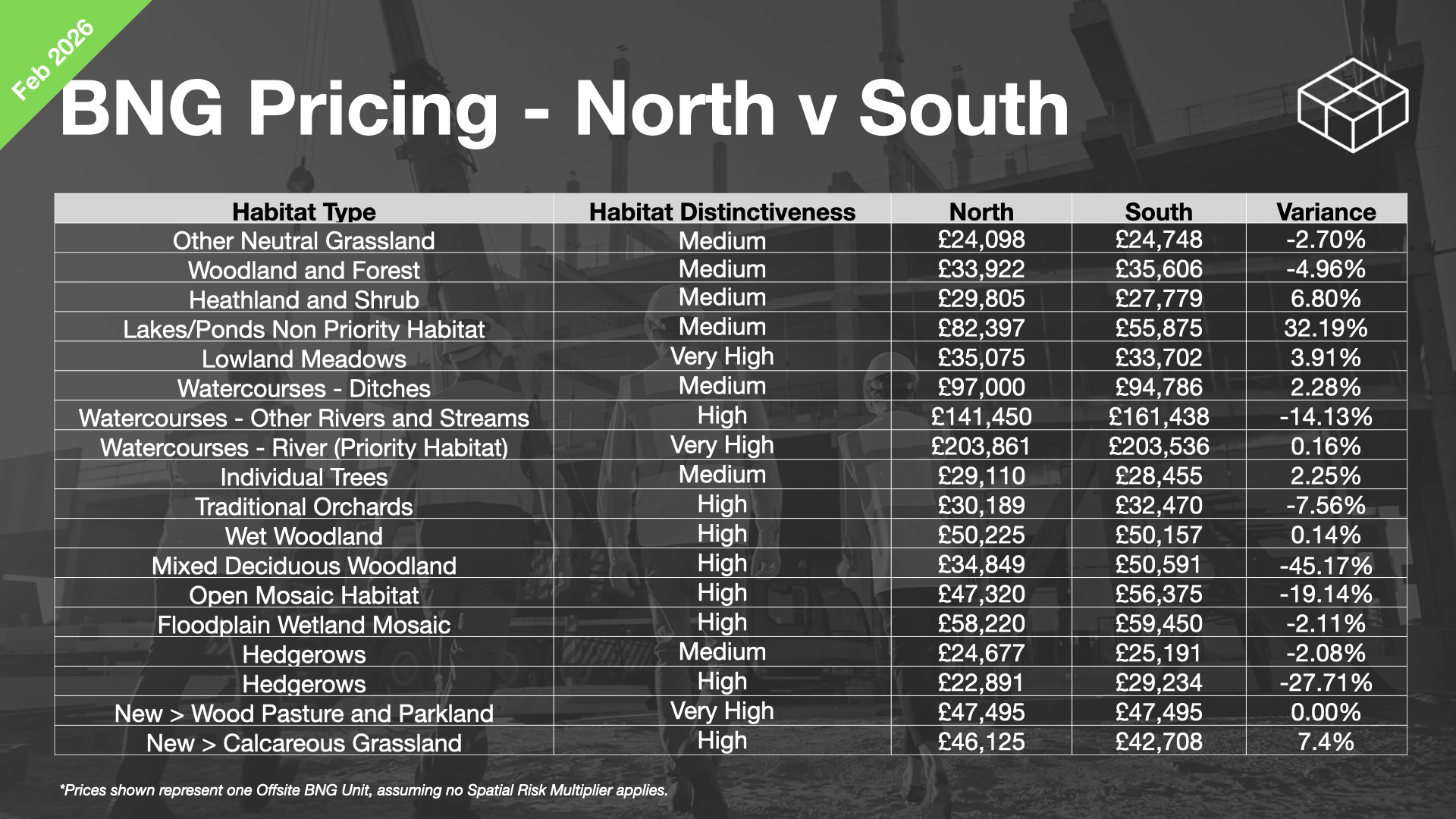

More abundant habitats including Other Neutral Grassland, hedgerows, and some woodland types have seen price reductions. Previously scarce habitats like ditches, Open Mosaic Habitat, and traditional orchards also show price corrections as supply increases.

For example, since our last report in October 2025, Other Neutral Grassland has decreased in price by 6.05% in the North and 2.82% in the South, whilst Traditional Orchards have fallen 16.41% in the North and 10.13% in the South.

Tiered release pricing creates early-mover opportunities

Many new habitat banks are discounting early tranches of units to secure initial deals and cashflow, with prices rising as projects mature and risk reduces.

In-area supply is now widespread

The vast majority of NCAs and LPAs now have at least one in-area supplier, meaning developers can increasingly avoid Spatial Risk Multipliers. However, depth of supply is limited - we assess most areas will need 2-4 active suppliers per NCA to ensure coverage across all unit types and genuine competition.

We have recently published a map of our supplier base - both available now and coming soon - which you can explore here.

Regional price differences persist

Some habitats show significant North-South variance. Mixed Deciduous Woodland is 45.17% more expensive in the South, whilst Lakes/Ponds Non-Priority Habitat costs 32.19% more in the North - reflecting land values, demand pressure and supply maturity.

Out-of-area discounting remains

Despite improving local supply, out-of-area transactions continue, especially in lower-demand NCAs as suppliers discount to offset Spatial Risk Multipliers. However, LPAs are increasingly scrutinising this and reinforcing the BNG hierarchy.

Collaboration between habitat banks is increasing

More operators are working together to fulfil complex requirements involving multiple habitat types, signalling a more coordinated and mature market.

Looking forward: the demand gap

Based on current trends, supply is likely to outpace demand over the next 1-2 years, before rebalancing later in the decade as allocations catch up. Additionally, BNG for Nationally Significant Infrastructure Projects is launching in May 2026 and will bring substantial new demand.

Navigating this dynamic market requires expertise. With tiered pricing, regional variations, and supply constraints in specific areas, developers need a partner who understands where units are available, which suppliers are reliable, and how to secure the right units at the right price for their project.

Ian Hambleton, Founder & Director of Biodiversity Units UK, commented:

"This market is moving fast and the dynamics create opportunities: to meet legislative requirements, help nature recover while getting the best prices. All of which underscores our mission to deliver BNG Certainty for our clients."

Get the full February 2026 BNG Pricing & Insights Report: sign up here

Need help securing BNG units and discharging your planning condition?

Our team is happy to help - and with Matched Pricing you get our market intelligence and responsive service at no premium.

Contact us on info@biodiversityunits.com